Financial problems can be a pain, especially when your bad credit score holds you back from getting a personal loan. Luckily, ASAP Finance makes it a doddle. Our partner lenders offer $2,000 loan options for borrowers with any credit. We know how hard it can be to manage life when things are rough, and money is tight. That’s why we’ve put together this partnership: you’ll never have to worry about missing out on opportunities.

Where To Borrow $2,000 Loan If I Have Bad Credit?

People with bad credit can borrow a $2,000 loan from a bank, credit union, or online lender. However, it may be a good idea to improve your rating first, as having a low credit score usually results in higher interest rates. If you need money quickly, online lenders are an option to consider. They usually have more relaxed eligibility criteria and transfer funds in as little as one business day.

What Is Considered Bad Credit?

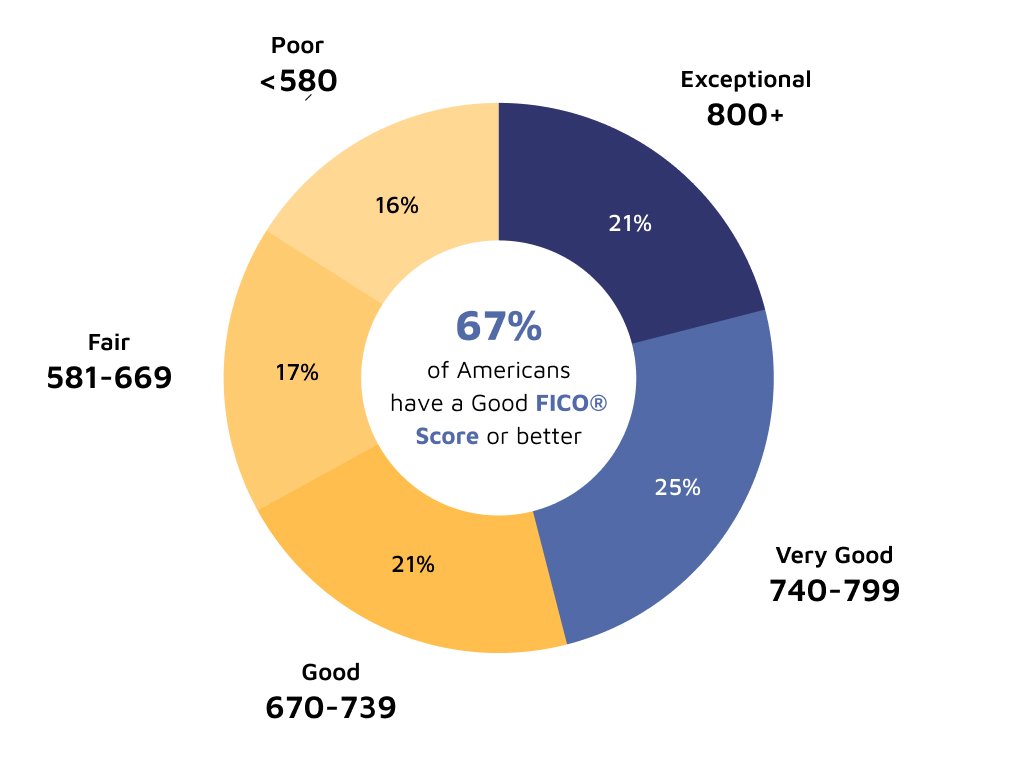

In the FICO scoring model with a scale ranging from 300 to 850, bad or poor credit is a score between 300 and 579. Here’s representation:

However, fair credit is also considered less-than-perfect. People with poor and fair credit are usually called “subprime”, meaning that traditional lenders are less willing to work with them.

Types of $2,000 Loans

Here are the types of two thousand dollar loans available on the lending market.

Traditional Personal Loan

A traditional personal loan allows you to borrow money from a bank or credit union on a long-term basis. It’s also known as an installment loan as it's repaid in equal monthly payments. Traditional loans are one-stop solutions for various personal needs but often require good credit.

Secured Personal Loan

A secured personal loan is a type of loan where you use your belongings as collateral to secure the loan. If you don’t repay the loan, the lender can take the items you used as collateral.

Home Equity Loan

Home equity loans are secured loans that use your home as collateral. The loan amount is determined by the equity you have in your home. Your home equity is the difference between the market value and what you owe on the property. Learn how home equity loans differ from mortgages.

HELOC (Home Equity Line of Credit)

A home equity line of credit (HELOC) is a second mortgage that allows you to use the equity in your home to access a revolving line of credit. Interest applies only on the amount you actually use.

Credit Card Cash Advances

A credit card cash advance is a short-term loan that allows you to borrow money against the credit limit on your credit card.

Am I Eligible to Apply for a $2,000 Loan?

Direct lenders have a few questions to ask you to determine the loan terms to offer and ensure you can afford to pay back each month. Check the eligibility criteria of most lenders:

- Be at least 18 years old;

- US citizenship or permanent residence;

- Active bank account (checking account);

- Valid phone number and email address.

How To Apply For a $2,000 Loan with Bad Credit?

The first step in applying for a $2,000 loan is to choose a lender. Many lenders provide this service, but choosing the right one may be difficult. ASAP Finance makes your search easier. You can apply here, on our website, and reach hundreds of payday lenders at once by taking the following steps.

Step 1 - Complete an online application form

Provide us personal details like name, address, phone number, bank, and employment information and submit the form. Then, it will automatically reach our partner loan providers.

Step 2 - Get a loan approval decision

Once the lenders receive your loan request, they review it and provide you with a loan approval decision. Note that lenders don’t guarantee you will be approved. However, we have a high approval rate.

Step 3 - Receive the money

If a lender approves your application, the lender will make a direct deposit right after you accept an offer. In most cases, borrowers get their loans within one business day!

When Should I Consider $2,000 Loans?

Whether you’re looking to pay off some bills, repair your car, or take a trip around the world, our installment loans for poor credit can help you get there. Here are some everyday situations where it might be worth taking into consideration:

- Your kitchen appliances suddenly break and you need to repair it or buy a new one.

- You have medical bills that need to be paid as soon as possible.

- You want to consolidate several debts to turn them into one loan with a single payment.

| Planning a full kitchen renovation instead of a simple fix? Explore smart kitchen remodel loan options to help finance your dream upgrade, even with less-than-perfect credit. |

|---|

2,000 Dollar Personal Loans vs. Payday Loans

If you’re looking for a personal loan, you might be tempted to go with a payday loan and confuse them. But before you do, it’s essential to consider the differences between 2,000-dollar personal loans vs. payday loans.

$2,000 personal loan. It is a long-term solution with repayment terms of up to 60 months. Their loan amounts start at $5,000 and go up to $15,000. The repayment is made in affordable monthly installments. Interest rates are usually between 5.99% and 35.99%, but the requirements for your minimum income and credit score can be strict.

Payday loans. These are short-term solutions that allow you to borrow up to $1,000, depending on the state. They should be repaid in full within just a few weeks, and the due date is tied to your next paycheck. They come with relaxed eligibility criteria and can be obtained fast, but interest rates can be over 400%.

Advantages and Disadvantages of a $2,000 Cash Loan

There is no such thing as a loan that’s right for everybody. So we’ll talk about the pros and cons of a $2,000 loan (bad credit report is allowed) so that you can make informed credit decisions about whether it’s right for you.

Advantages:

- You may use the funds for any personal needs without restrictions;

- Bad credit history is allowed;

- Flexible repayment terms;

- No hard credit checks through major credit reporting bureaus;

- Quick money deposits;

- Easy online application with no paperwork;

- Almost instant approval decisions.

Disadvantages:

- Potentially high interest rates;

- Lenders may charge extra costs, such as origination fees, late fees, and prepayment penalties;

- $2,000 personal loans may affect your credit if you default.

Cost of a $2,000 Loan

A $2,000 loan can vary in terms of its cost, depending on the lender and a borrower’s credit and financial state. Traditional lenders usually offer loans at 5.99% to 35.99% APRs, while online loan providers may charge higher interest. The factors that can directly affect your loan cost include your location, credit score, income, debt-to-income ratio, employment history, and the repayment term you pick. Here are calculation examples:

| Repayment Terms | APR | Monthly Payment | Total Loan Costs |

|---|---|---|---|

| 6 months | 24.99% | $358.05 | $2,148.28 |

| 12 months | 15.7% | $181.18 | $2,174.13 |

| 24 months | 12.99% | $95.07 | $2,281.78 |

What Are My Alternatives for $2,000 Loans?

There are plenty of loan options if you’re looking for quick cash. Here are some of the best alternatives to $2,000 loans out there:

Ask money from friends and family

If you have any close friends or relatives who are financially stable, they may be able to give you the cash quickly, and they’ll likely be happy to help you despite your credit score.

Get a secured credit card

Secured credit cards require you a deposit—usually around $300. This deposit is held in an account and acts as collateral for the card. If you don’t pay back your balance, your deposit will be used to cover the cost. Sometimes, these cards have a 0% interest rate.

Use a co-signer

A co-signer is someone who agrees to sign a bad credit loan with you, which means they’re responsible for paying off any debt that you’ve accrued. If you don’t pay back the $2,000 loan, your cosigner will be on the hook for it.

Get a $2,000 Personal Loan with ASAP Finance!

At ASAP Finance, we can help you get a $2,000 personal loan fast, regardless of your credit. Our direct lenders offer multiple loans for bad credit scores at competitive interest rates and with flexible repayment options. Enjoy our easy application processes and get the money you need by tomorrow. Fill out our simple application form and get an offer from a trusted lender within one hour.

Frequently Asked Questions

01

What credit score do you need for a 2,000 dollar loan?

The amount of credit you need for a 2,000 dollar loan depends on your income and monthly expenses. If your income is high but most of it goes toward paying rent and other debts, a lender may not approve your for a $2,000 loan. At the same time, borrowers with lower earnings but little monthly expenses could qualify.

02

Can I Get a $2,000 Loan Instantly?

You can get a $2,000 loan instantly by withdrawing money from your credit card balance or pledging something in a pawn shop. Another quick way is to apply for a loan via an online lender. This way, you can get money on the same or next day, depending on the time you apply.

03

How do I repay my $2,000 loan?

First, you must ensure that you keep track of your monthly payments as they come due. It is also essential to know when your $2,000 loan will be paid off. The lender usually withdraws the loan amount and its costs from your bank account, and it’s done! This practice is online and 100% safe.

04

How Quickly Can I Receive my $2,000?

Lenders usually make direct deposits as soon as the next business day of the loan agreement signing. For example, if your loan is approved on Friday, you’ll receive your money on Monday.

05

Can you get a $2,000 personal loan with no credit?

It’s possible if you pick the lender that accepts those who are new to credit. Our partner lenders have no minimum credit score requirement, so you can be approved for a $2,000 personal loan with no credit.

06

How to get $2,000 dollars fast with bad credit?

The fastest way to get $2,000 dollars with bad credit is by withdrawing it from your credit card balance if your limit allows it. You can also turn to bad credit friendly online lenders and receive the funds within 24 business hours.

Need a $2,000 loan with bad credit? Get it in a few clicks! Apply Online NowI read and agree to Terms, Rates, Privacy Policy before submitting a loan request.