Rates and Fees

ASAP Finance is a well-established finance company providing online matching services. We help our customers with bad credit scores to find online payday loans to cover their financial needs. We connect you to a vast industry-leading panel of direct lenders, saving you time and effort. Our technology processes hundreds of loan requests every day. Our loans provide you financial relief in most urgent situations.

ASAP Finance doesn’t charge additional fees. You can rest assured you receive a fair service, and your personal data is safe with us.

Representative APR Range

ASAP Finance is not a lender and does not provide short-term loans but refers consumers to the lenders who may provide such loans. ASAP Finance is unable to supply you with an exact APR (Annual Percentage Rate) that you will be charged if you are approved for a loan. The APRs vary according to the information supplied by you in your loan request and your lender. You will be given the APR, loan fees, and other terms by your lender when you are redirected to your loan agreement in the loan request process. Payday loans are relatively expensive when compared with other loan products. Payday loans are not recommended as a long-term financial solution and they should only be taken for emergency financial needs.

The APR on a short-term loan can range from 212% to 1,890% depending on how the APR is calculated (nominal vs. effective), the duration of the loan, loan fees incurred, late payment fees, non-payment fees, loan renewal actions, and other factors. Here are Payday Loans Rates and Fees by State to see short-term loans’ interest rates in different states. Keep in mind that the APR range is not your finance charge and your finance charge will be disclosed later on.

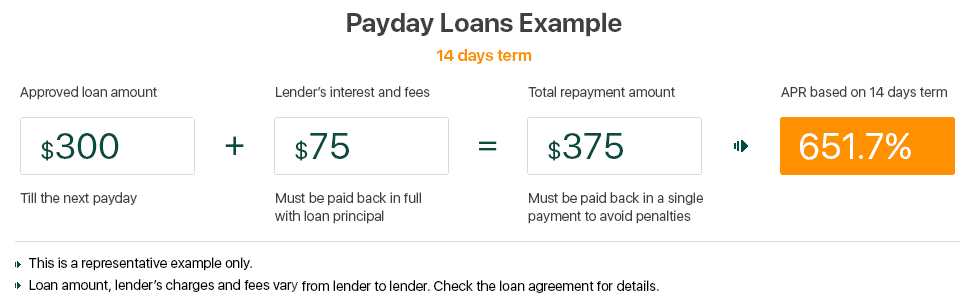

Payday Loans APR Calculation Representative Example

Borrow a $200 no credit check loan for 14 days with a $30 to $60 lender fee. Your estimated APR is 391% to 782%

Calculation: (lender fee / loan amount) x (amount of days in a year / duration of the loan) x 100

Low End of Range: ($30 / $200) * (365 days / 14 days) x 100 = 391.07%

High End of Range: ($60 / $200) * (365 days / 14 days) x 100 = 782.14%

Single Payment Payday Loan

A Payday loans term may range from 5 to 30 days. The loan amount varies from $50 to $1,000 in $25 increments. Lenders charge $10 to $40 per each $100 amount borrowed. Borrowers may get lower fees by meeting the following requirements:

- Providing ACH authorization

- Building a good repayment history with the current lender.

The APR varies based on the loan term, lender’s fees, amount borrowed, and state of residence. The following table explains the fees and APR for a 14 day cash advance.

| Loan Amount, $ | Lenders Charges, $ | Total Amount, $ | APR*, % |

|---|---|---|---|

| $300 | $75 | $375 | 651.7% |

| $500 | $125 | $625 | 651.7% |

| $1,000 | $250 | $1,250 | 651.7% |

* APR assumes a 14-day term.

How to calculate payday loans APR?

To understand the outcome, let’s see a $300 same day loan example. The Payday Loan has the following features:

- Loan amount: $300

- Total financial charges: $75

- Repayment period: 14 days

Follow these steps to calculate Payday Loans APR.

- Divide the total financial charge by the loan principal: $75 / $300 = 0.25. It shows how much the borrower overpays for each dollar borrowed. 0.25 converts to a rate of 25%, which means 25 cents for every dollar.

- Multiply that result by 365 days in a year: 0.25 x 365 = 91.25

- Divide that result by the loan term: 91.25 / 14 days = 6.517

- Move the decimal point 2 spaces to the right to transform it into APR and add the percentage sign: 651.7%

The results above are for timely payments! Other fees that the borrower may have to pay are:

- Late payment charge – 5% of payment amount, if delayed for 10 days or more.

- Dishonored charge of $30.00 for any returned check or electronic payment.

- Loan renewal or extension fee.

If the borrower fails to repay the loan on the due date, an extended payment plan or EPP may be an option. EPP is available once in any twelve months period.

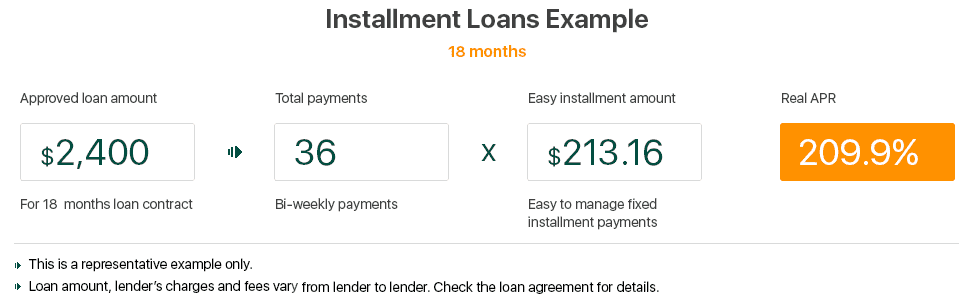

Installment Loans for Subprime Credit

We made up bi-weekly and monthly payment examples: The APR is 209.9% for a loan of $2,600. The borrower has to make 36 or 18 installment payments over 18 months.

| Loan Amount | Number of Payments | Installment Payment* | Lender’s Charges | Total Amount | APR*, % |

|---|---|---|---|---|---|

| $2,400 | 36 | $213.16 | $5,273.62 | $7,673.62 | 209.9% |

| $2,400 | 18 | $444.20 | $5,595.67 | $$7,995.67 | 209.9% |

* Monthly payments are fixed and do not include any additional charges that may be applied.

** Representative APR is based on one of our lender’s terms and conditions.

When do I have to repay an Installment Loan?

The average period is 18 months. For borrowers who get their income on a weekly or fortnightly basis, the loan repayment schedule consists of 36 scheduled installments. The customers that get income once a month, have to make 18 installment payments. Failing to make payments will lead to penalty fees and a negative effect lower credit score.

What is an early loan repayment?

ASAP Finance enders don’t apply penalties for paying off installment loans early. Save on interest by making early payments or pay off extra amounts on the established installments. We encourage paying off a loan as soon as possible.

Are there any additional charges for Installment Loans?

Each lender has different rules, and the borrower must check this information before applying. According to the Fair Lending Act lenders must disclose all charges in the loan agreement.

Is there any possibility to cancel the loan contract?

Usually, the consumers may cancel the loan agreement at no cost within three business days prior to the loan activation date and can do so by phone or via email.

Other fees that may be charged by lenders

- Late payment fees (usually if the payment is over 10 days late);

- Dishonored item charge;

- Refinancing fees if you choose not to pay the loan in full on due date.

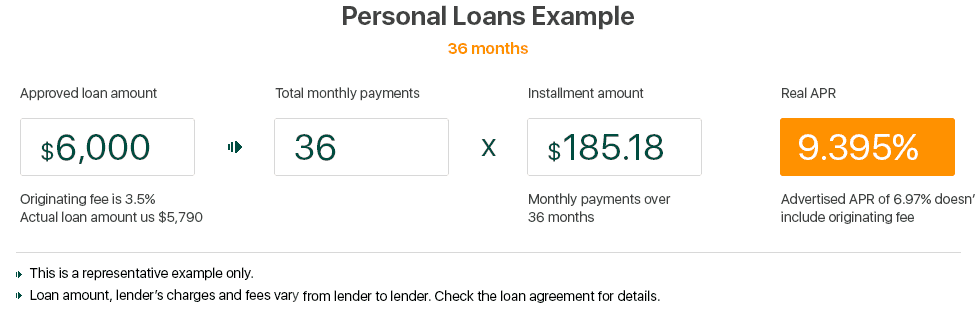

Personal Loans – Rates, Fees, Charges, Calculations, FICO scores

Borrowers with good and excellent credit history may apply for loans at rates from 5.0% to 14.99%. This is considerably lower than credit card rates or other ways of financing. Personal loans are a good way to finance planned, large purchases such as credit cards payoff, home improvement, medical or wedding expenses and can be used for debt consolidation. Below we have provided some calculations on an average personal loan applying APR rates and credit ratings for a loan amount of $10,000 over a 3-year term.

* Not all consumers will qualify for the presented APR. Base on surveys and statistics from the sources at the bottom of this page.

* The average APR is based on data provided by the main lenders in our network for Q1, 2017.

Personal loans with low rates are often given to prime credit applicants – those having 780+ credit scores. The borrowers with credit scores below 580 may not qualify for a loan or be approved for high APR loans.

What are the amounts for personal loans?

Personal loans in our network range from $5,000 to $35,000. The approved amount depends on the lender, the borrower’s credit history, requested amount, monthly income, and state of residence.

Rates for personal loans

APRs for loans range from 5.99% to 35.99%. All personal loans have fixed rates and fixed monthly payments. The lending fees and charges consists of the following:

- Yearly interest rate

- Origination fee

- Insurance, that comes with a loan

- Applicable penalty fees, if any

Personal loans fees

- Origination fees range between 1.00% and 6.00% of the loan amount and are charged if a borrower gets a loan.

- Early payment fees – Some lenders may charge up to 2% of the loan amount for earlier payments. We suggest checking the loan contract prior to making any extra payments or paying off a loan early.

- Application or brokerage fees - Applying for a loan via a third party broker may lead to additional commissions. We do not charge any fees for obtaining a loan through our website!

- Late payment fees are charged if the borrower fails to make monthly installment payments on time. Late fees and penalties are specified in the loan agreement.

Financial Implication and Penalties

Implications of Late Payment

You are encouraged to contact your lender as soon as possible if you are unable to repay your loan on the scheduled repayment date. Your lender will set its own late payment fees in accordance with state regulations. Your lender may have several courses of action available if your payment is late. For more information about your lender’s specific procedures as they apply to late payments, please, review your loan agreement or contact your lender directly.

Implications of Non-Payment

The costs associated with loans of up to $500 can range from 15% to 40% of the entire loan amount, and the charges associated with loans of more than $500 can be even more. Your lender may also charge late fees as well as fees for non-sufficient funds. As an example, your lender may charge you a $20 insufficient funds fee as well as 15% of the loan balance as a late fee. Please review your loan agreement carefully for information about the financial implications of non-payment before you provide your electronic signature.

Collection Practices

The majority of the lenders in our network will not sell your debt to outside collection agencies. Instead, they may attempt to collect the debt in-house via telephone, email, postal mail or even text message. Similarly, they will not threaten criminal charges or sue borrowers; they will generally offer debt settlements over time instead. Every lender in our network is required to adhere to the Fair Debt Collection Practices Act which protects consumers from being abused or harassed by debt collectors.

Impact on Credit Score

Lenders have the right to report your failure to repay a loan to one or all of the major credit reporting agencies — Experian, Equifax, and Transunion. This negative report will be reflected on your credit history indefinitely until the loan is repaid in full. After the lender has received the payment in full, they can report this to the credit reporting agencies and the report may be removed from your record.

Renewal policy

Some of the lenders in our network may automatically renew your loan if it becomes past the due date. You should check your loan agreement for your lender’s policy on automatic loan renewal prior to e-signing your loan agreement. If your loan is renewed, there will be additional charges as determined by your lender, and the minimum term can be set up. Your lender may offer you other options in addition to renewal, including the ability to repay your loan in full at a later date or repay your loan over time in a series of installments.

Our Lending Policy

The policy of ASAP Finance is to make loan products available to all qualified applicants without discrimination based on national origin, race, color, sex, religion, age (over that of majority), or handicap.

We treat all our consumers fairly and consistently in compliance with fair lending practices. Our customer service will offer you the needed assistance and guidance equitably and consistently.

ASAP Finance devotes special attention to the people with bad credit. We provide safe financial services to all applicants, regardless of their credit histories or current financial situations.

Our commitment to fair lending principles is demonstrated in terms of our clients' satisfaction and loyalty and our partners' long-term collaborations.