Personal Finance Blog

How to Get a Wedding Loan with Bad Credit?

A wedding loan can help you finance your big day and reduce the financial burden, allowing you to cover the cost in affordable monthly payments. This unsecured option can be used for a wide range of related expenses, from wedding rings to dresses, venues, or catering. While credit issues make it more challenging to qualify

Latest Blog Posts

Kitchen Remodel Loans: Ways to Finance Your Dream Kitchen

Kitchen renovation can be costly. The average kitchen remodel in the US costs around $26,972. However, actual expenses vary widely based on project scope. Mid-range kitchen remodels often run about $75,000 – $80,000, while high-end renovations can even exceed these numbers. With such price tags, few homeowners can cover these expenses upfront. Instead, they turn

Crypto Loans Without Collateral: Insights That Matter

Crypto loans without collateral are growing in popularity among traders and businesses. This article explores flash loans, their quick approval, and lack of security requirements. We’ll also examine potential risks, and review top platforms that offer unsecured crypto loans, providing valuable insights for crypto investors.

Cash Advance for DoorDash Drivers: Loan Options for Gig Workers

Looking for quick cash as a DoorDash driver? Explore cash advance options like payday and installment loans tailored for gig workers. Learn about fast application processes, no-credit-check benefits, and tips for managing unexpected expenses. While these loans can be a lifeline in emergencies, it's crucial to weigh the costs and repayment terms to avoid financial pitfalls.

Why Are African Americans More Likely to Steal at Christmas Than Others?

The number of shoplifting cases increases heavily during the festive season, with the most of retail theft happening in the four weeks before Christmas. While statistics say that White people top the list of shoplifting offenders, 2.38% of Black Americans shoplift compared to only 0.59% of White Americans. Read on for more statistical data analysis and personal stories and explore factors that lie behind this phenomenon.

What Is a Guarantor on a Loan, and Is It Worth Involving One?

Loan guarantors provide financial backup when borrowers struggle. This helps people with bad credit issues, but it also has its drawbacks. Guarantors take on major responsibilities, so both parties should consider the arrangement carefully. Keep reading to find out more.

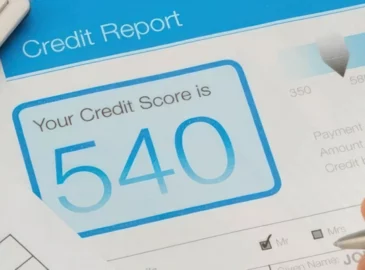

Can I Get a Loan with a 540 Credit Score?

Your credit score is an important parameter lenders use to determine your loan eligibility. Having a credit score of 540 may hold you back from getting most traditional loan options as it's considered poor credit. This means that you have made some financial mistakes in the past. Still, there are loan products avaiable to people with less-than-perfect scores. Here's a closer look at your options and some considerations regarding them.

Line of Credit vs. Loan: Which Suits You Best?

Choosing between a line of credit and a loan depends on your financial needs. A line of credit offers more flexibility since you repay as much as you use, while a loan provides a lump sum for specific expenses. Analyze your situation to pick the best option for your situation.

Distinct Differences Between Title Loans and Payday Loans

Financial issues often lead individuals to consider title or payday loans for immediate relief. However, these quick-fix solutions can trap borrowers in cycles of high-interest debt. Title loans, secured by your car, offer substantial sums with brief repayment periods and steep interest rates, while payday loans, unsecured and based on income, provide smaller amounts but with even higher APRs. Knowing the pros and cons of each can help you make an informed decision.

Loans Like LendNation

Finding the right loan can be challenging, especially when urgent. LendNation offers convenient short-term lending, but other institutions provide similar services with better terms. We'll explore alternatives to LendNation, focusing on small cash loans and flexible installment options to help you choose the best loan for your needs.

Loans for Independent Contractors with Bad Credit

Working as a 1099 employee allows you to choose when and where you work, but it comes with financial challenges, especially when getting credit. Self-employed individuals face irregular income, which limits their access to loans and credit cards. Bad credit makes things worse, but there are solutions. You can get affordable loan options for self-employed people with bad credit, including SBA programs, personal loans, credit cards, and advanced apps. You can qualify for these loans and improve your credit for better terms.